Car title loan consumer advocacy groups are essential for protecting borrowers from scams and unfair practices in the complex car title loan landscape. By understanding common tricks like minimal requirements and hidden fees, consumers can scrutinize interest rates, repayment terms, and lender legitimacy through licensing and reviews. These groups empower consumers with knowledge about their rights, transparent fee structures, and legal repossession procedures, enabling them to avoid scams and high-interest rates for a safer borrowing experience. Choosing licensed lenders in your state ensures secure terms, pressure-free interactions, tailored options, and priority on your financial well-being.

Staying informed is your best defense against predatory car title loan scams. This guide, powered by leading consumer watchdog organizations, equips you with the knowledge to recognize red flags and protect your rights as a borrower.

Learn about common scams targeting unsuspecting vehicle owners and discover your protections under the law. We offer practical tips on reputable lending practices to safeguard your property and ensure a safe borrowing experience.

- Understanding Title Loan Scams: Red Flags to Spot

- Consumer Rights and Protections for Car Title Loans

- Safeguarding Your Property: Tips for Reputable Lending

Understanding Title Loan Scams: Red Flags to Spot

Car title loan consumer advocacy is crucial to navigating the often-misunderstood world of title loans. Understanding what a title loan scam looks like is the first step in protecting yourself from unfair practices. Red flags abound, especially when lenders offer quick cash with minimal requirements, such as no credit check. This apparent ease and lack of vetting can be a dangerous lure.

Pay close attention to how much interest is charged and over what period. Unscrupulous lenders might quote low initial rates but then tack on hidden fees or demand full repayment in a shorter time frame than expected, making the loan unaffordable. Always verify the lender’s legitimacy by checking their licensing and reviews, ensuring you’re dealing with a reputable institution throughout the title loan process.

Consumer Rights and Protections for Car Title Loans

When it comes to car title loans, consumers have specific rights and protections. Car title loan consumer advocacy groups play a crucial role in ensuring lenders adhere to these regulations. These organizations offer valuable tips on how to avoid scams and make informed decisions. One of the key protections is that lenders must provide a clear breakdown of fees and interest rates, allowing borrowers to understand the full cost of the loan.

Additionally, consumers have the right to keep their vehicle as collateral, even if they default on the loan. This means the lender cannot repossess your car without following legal procedures. It’s also important to remember that while same-day funding is a common feature of car title loans, taking your time to compare offers and understand the terms can save you from high-interest rates and hidden fees.

Safeguarding Your Property: Tips for Reputable Lending

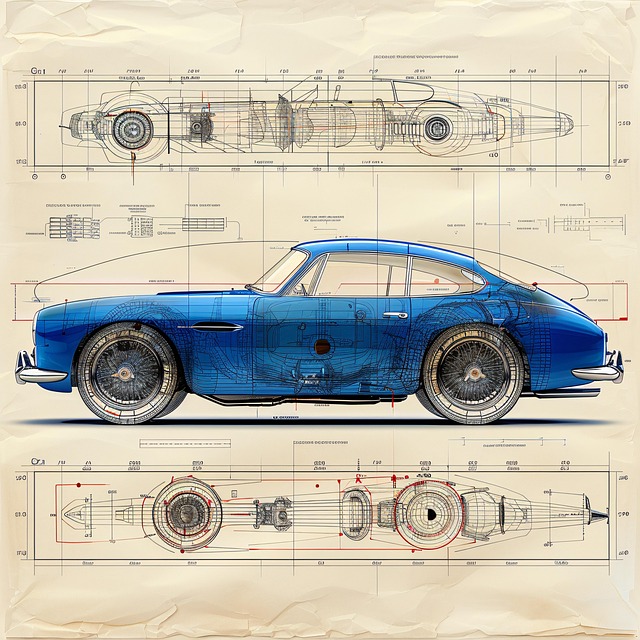

Protecting your property is a vital aspect of responsible borrowing. When considering a car title loan, it’s crucial to ensure that you’re dealing with a reputable lender who respects your assets and financial well-being. Start by checking for licensed lenders in your state, as this guarantees certain levels of consumer protection. Reputable lenders will offer transparent terms, clearly outlining interest rates, repayment schedules, and any fees associated with the loan.

Avoid lending institutions that pressure you into rushed decisions or require unnecessary collateral. A legitimate lender should focus on helping you understand the loan process and providing options tailored to your needs, whether it’s a cash advance, debt consolidation, or San Antonio loans. Remember, safeguarding your property means ensuring both the security of your asset and your financial stability.

In navigating the complex landscape of car title loan consumer advocacy, staying informed and vigilant is key. By understanding the red flags and exercising your rights, you can protect yourself from potential scams. Remember, legitimate lenders prioritize transparency and fair practices, ensuring your property remains secure. Stay alert, seek advice when needed, and make informed decisions to safeguard your financial well-being.