Car title loans Texas designed for seniors offer fast, secure funding using vehicle titles as collateral, avoiding traditional banking. With flexible terms including weekly, bi-weekly or monthly payments, and online applications for quick approval, these loans cater to those with limited mobility. Effective management involves creating a budget, consolidating debts, and timely repayments to save on interest, building a positive financial history.

In Texas, car title loans offer a unique financial solution for seniors seeking short-term funding. Understanding this lending option is crucial for managing repayment and avoiding pitfalls. This article guides seniors through navigating car title loan repayments in Texas, exploring various strategies and tips to ensure successful management. Learn about flexible options, budget planning, and best practices to maintain financial stability while repaying your loan efficiently.

- Understanding Car Title Loans for Seniors in Texas

- Navigating Repayment Options and Strategies

- Tips for Effective Management of Loan Repayments

Understanding Car Title Loans for Seniors in Texas

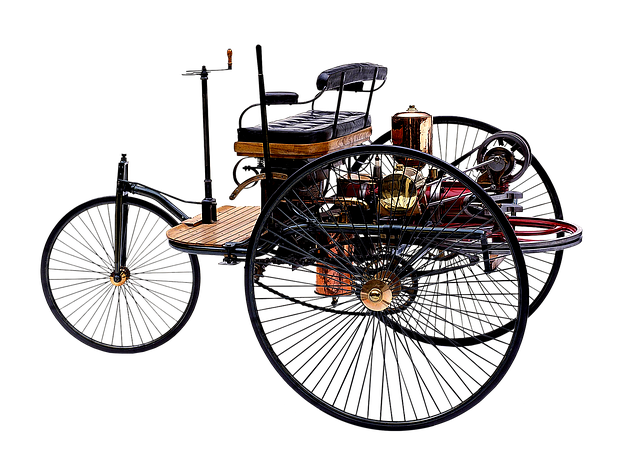

In Texas, car title loans have emerged as a financial option tailored to seniors’ needs, offering a secure and convenient way to access capital. This type of loan uses an individual’s vehicle title as collateral, providing a straightforward and often faster alternative to traditional bank loans. For seniors seeking short-term funding or emergency expenses, car title loans Texas for seniors can be particularly beneficial. The process involves pledging the vehicle’s title, ensuring that the lender has a clear legal claim in case of default. However, it’s crucial to understand that this security also means the borrower must keep their vehicle as collateral until the loan is repaid.

San Antonio loans, like any other car title loan, come with flexible payment plans designed to accommodate seniors’ varying financial capabilities. These loans are typically structured for shorter terms, allowing borrowers to repay the amount over a few months rather than years. This flexibility is essential in ensuring that seniors can manage their repayments without sacrificing daily transportation or facing the potential loss of their vehicle if they miss payments, as keeping your vehicle is a key advantage of these loans.

Navigating Repayment Options and Strategies

Navigating repayment options is a crucial step for seniors considering car title loans Texas. These short-term loans offer flexible terms tailored to borrowers’ needs, allowing them to choose between weekly, bi-weekly, or monthly installments. Many lenders also provide the option of online applications and quick approval processes, ensuring a swift and efficient loan acquisition experience. This convenience is especially beneficial for seniors who may have limited mobility or access to traditional banking services.

Strategizing repayment involves understanding the interest rates and fees associated with car title loans Dallas. Comparing different lenders and their terms can help seniors find the best deal. Additionally, maintaining open lines of communication with the lender is key. Lenders often work with borrowers to adjust repayment plans based on unforeseen circumstances, ensuring a manageable and sustainable loan repayment journey for all Texas senior citizens.

Tips for Effective Management of Loan Repayments

Managing your car title loan repayments effectively is a crucial step for Texas seniors to maintain financial stability. Firstly, create a detailed budget that allocates funds for loan payments alongside essential living expenses. This ensures you never miss a repayment due to unforeseen costs. Additionally, consider consolidating other debts into your loan if they carry higher interest rates, making it easier to manage multiple payments.

For those in Fort Worth or across Texas seeking car title loans, the process is designed for quick funding without the typical credit check, providing a sense of financial relief. However, remember that timely repayments not only save on interest but also build a positive repayment history, which can be beneficial if you ever require another loan in the future.

Car title loans Texas for seniors offer a valuable financial resource, but managing repayments is crucial for a positive borrowing experience. By understanding various repayment strategies and implementing effective management tips, seniors can navigate these loans seamlessly. It’s essential to choose a plan that aligns with individual financial capabilities and to stick to a consistent repayment schedule. With careful planning, car title loans can provide the funds needed while maintaining a secure and manageable debt structure.