Texas title loans for college students offer quick funding for education expenses not covered by financial aid, but come with risks of vehicle loss and high interest rates. Students should strategically plan repayments, explore alternative funding, and understand loan terms to ensure long-term financial stability.

“Navigating the financial landscape of higher education can be a daunting task, especially for students considering alternative funding options. In Texas, a growing trend is the use of Texas title loans for college students, offering quick access to cash. This article delves into this unique lending option, providing insights on understanding Texas title loans specific to students, exploring their benefits and drawbacks compared to traditional financial aid, and offering practical repayment strategies. By the end, students will be equipped with knowledge to make informed decisions about managing their finances.”

- Understanding Texas Title Loans for College Students

- Benefits and Drawbacks of Title Loans for Financial Aid

- Effective Strategies to Repay Your Texas Title Loan

Understanding Texas Title Loans for College Students

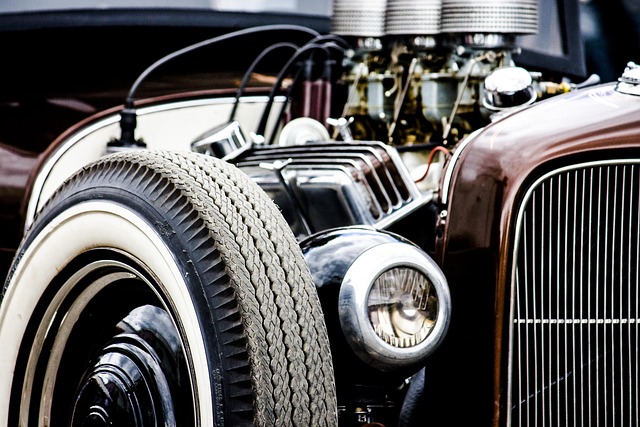

In the competitive world of higher education, many college students find themselves seeking alternative financial solutions to bridge the gap between their expenses and financial aid packages. One option that has gained popularity among students in Texas is the Texas title loan for college students. This type of short-term lending utilizes a student’s vehicle as collateral, offering a quick and accessible way to secure funds for educational costs. Understanding how these loans work is crucial for making informed decisions about managing one’s finances during college.

When considering a Texas title loan for college students, it’s essential to explore the various repayment options available. Lenders typically provide flexible schedules, allowing borrowers to pay back the loan over an extended period, which can help manage cash flow. Additionally, while interest rates may vary among lenders, understanding the potential financial impact is vital. Students should carefully review the terms and conditions, including interest rate structures, to ensure they are comfortable with the repayment burden, especially given their limited income during college years.

Benefits and Drawbacks of Title Loans for Financial Aid

Texas title loans for college students can serve as a quick financial solution for those facing immediate cash flow issues. One significant benefit is same-day funding, ensuring that borrowers receive access to funds swiftly, which can be crucial during urgent financial needs, such as paying unexpected tuition fees or covering emergency expenses. This option is particularly appealing to students who may not have established credit histories and thus struggle to qualify for traditional loans.

However, it’s essential to consider the drawbacks of Texas title loans for college students. Keeping your vehicle as collateral means there’s a risk of losing it if you fail to repay the loan on time. Additionally, these loans often come with higher-than-average interest rates and fees, making them more expensive in the long run compared to alternative financial aid options. While they offer quick cash, it’s vital for students to explore all other financial aid resources and consider whether a title loan aligns best with their long-term financial goals and sustainability.

Effective Strategies to Repay Your Texas Title Loan

Repaying a Texas title loan for college students requires careful planning to ensure you meet your financial obligations while also managing your education expenses. One effective strategy is to create a detailed budget that allocates funds for loan repayment, tuition fees, books, and living costs. Prioritizing debt repayment can help reduce the overall interest burden. Students should aim to make more than the minimum payments each month to pay off the loan faster and save on interest charges.

Additionally, exploring alternative funding sources or considering part-time employment alongside studies can supplement repayment efforts. Some financial institutions offer flexible loan terms tailored for students, allowing them to adjust payment schedules around exam periods or internships. Regularly reviewing loan terms and communicating with lenders about any challenges is crucial. Furthermore, a thorough vehicle inspection (if the Texas title loan is secured against a car) can help ensure the vehicle’s value aligns with the loan amount, promoting responsible borrowing practices.

For college students in Texas, understanding the nuances of a Texas title loan can be a game-changer when it comes to financial planning. By weighing the benefits and drawbacks and employing effective repayment strategies, students can leverage these loans as a tool for funding their education without getting overwhelmed by debt. Remember that, while a Texas title loan can provide much-needed financial aid, proper management is key to ensuring it doesn’t become a burden.