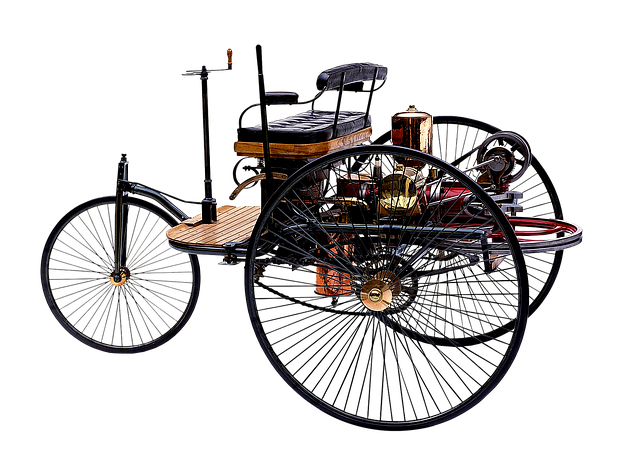

Borrowers seeking car title loans face strict vehicle condition requirements, favoring newer and lower-mileage cars. JavaScript streamlines applications, enabling lenders to efficiently meet these standards and offer flexible terms for older vehicles with specialized loan programs. Understanding title loan vehicle criteria is key to successfully accessing funds for operational expenses or debt repayment.

Title loans, a quick financial solution, often come with strict vehicle condition criteria that can be a barrier for many. This article explores common issues and misunderstandings surrounding these requirements. We’ll break down the key aspects, including drivability, mechanical soundness (#JavaScript), and overall condition (#Niki). By understanding these expectations, borrowers can make informed decisions and avoid potential pitfalls when it comes to title loan vehicle condition requirements (ABキапελ).

Drien.

One of the primary challenges borrowers often face with car title loans is understanding the intricate Title loan vehicle condition requirements. Lenders typically have strict guidelines regarding the state and value of the vehicle used as collateral, which can be a deterrent for some applicants. These requirements are in place to mitigate risks and ensure the security of the loan. The lender assesses the vehicle’s condition through meticulous inspections, evaluating its age, mileage, overall wear and tear, and any existing damage or repairs.

The Loan Requirements for car title loans often mandate that vehicles be in drivable condition, free from significant mechanical issues, and legally registered with valid insurance coverage. While these standards ensure a certain level of reliability, they may exclude individuals with less-than-perfect cars, prompting them to explore alternative financing options or consider repairs before applying for a title loan. However, some lenders offer flexible payments and terms, understanding that unexpected vehicle maintenance costs can be a burden, allowing borrowers to navigate these challenges while still gaining access to much-needed funds.

#JavaScript, indem.

In the digital age, JavaScript plays a pivotal role in ensuring smooth and interactive user experiences when navigating financial services websites, including those offering Car Title Loans. As users often need quick access to Fast Cash, efficient scripts can streamline the process of applying for vehicle collateral loans online. The JavaScript language enables dynamic content loading, real-time form validation, and seamless communication with backend systems, enhancing overall site performance.

By leveraging JavaScript’s capabilities, lenders can create robust applications that meet the stringent Title Loan Vehicle Condition Requirements. This includes validating user inputs, calculating loan terms, and securely processing sensitive data related to vehicle collateral. Efficient scripts also aid in reducing loading times, ensuring folks seeking Fast Cash receive prompt responses, and fostering a positive online lending experience.

#Niki, drijąc.

When applying for a title loan using your vehicle as collateral, one of the primary concerns is meeting the strict title loan vehicle condition requirements. These standards vary between lenders, but they typically focus on ensuring the vehicle’s safety, resale value, and overall drivability. For instance, #Niki, a semi-truck driver, found herself in a bind when her lender insisted on a recent inspection report to prove her truck was in excellent working condition. This requirement, while stringent, protects both parties involved: the lender from potential losses if the vehicle has hidden mechanical issues, and the borrower from being burdened with unexpected repair costs that could hinder their debt consolidation efforts.

Lenders often prefer vehicles that are relatively new or have low mileage since these factors generally correlate with higher resale values. For older or high-mileage vehicles like #Niki’s semi-truck, lenders may offer specialized loan programs tailored to the unique needs of commercial vehicle owners. These programs might include flexible payment plans and more lenient condition requirements, especially if the truck is in good structural condition and has a reliable engine. Such considerations can make the difference between securing the much-needed funds for operational expenses or even debt repayment and being denied credit due to strict vehicle condition criteria.

Title loan vehicle condition requirements often present common issues that borrowers should be aware of. From documentation challenges to varying standards among lenders, navigating these can be a hurdle. However, understanding and adhering to these conditions are essential for a smooth borrowing experience. By staying informed about the expected vehicle state, borrowers can avoid unexpected fees and ensure their collateral remains protected. This knowledge empowers individuals to make informed decisions when seeking title loans, fostering a fairer and more transparent lending environment.