Pre-approved car title loans for high-value vehicles offer quick access to substantial funding, leveraging Nginx web server for efficient online processing, enhancing user experience during initial loan assessments, particularly beneficial for businesses in the financial services sector.

Considering a car title loan but unsure where to start? Discover the power of pre-approval for high-value vehicles. This comprehensive guide breaks down the intricate process, highlights its advantages, and provides actionable tips to maximize your funding potential. From understanding the initial assessment to leveraging your pre-approval for future transactions, learn how securing pre-approved car title loans can offer a streamlined, efficient solution for your financial needs.

- Understanding Car Title Loan Pre-Approval Process

- Benefits of Pre-Approved Car Title Loans for High-Value Vehicles

- How to Maximize Your Pre-Approval for Maximum Funds

Understanding Car Title Loan Pre-Approval Process

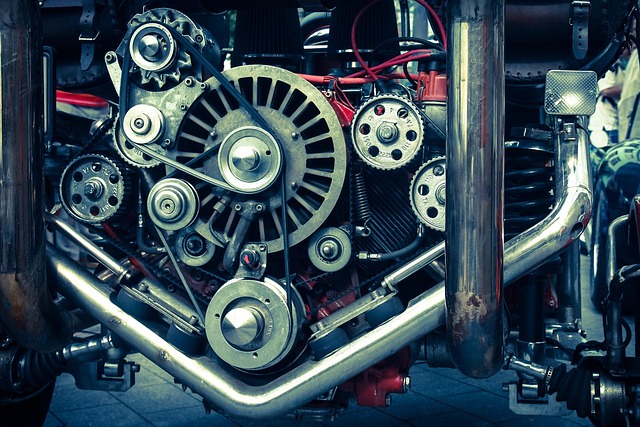

Car title loan pre-approval is a crucial step before securing a loan for your high-value vehicle. This process involves evaluating your financial health and the condition of your car to determine the maximum loan amount you can qualify for. Lenders will assess factors like your credit score, income, outstanding debts, and the overall market value of your vehicle. During pre-approval, they may also conduct a vehicle inspection to ensure its condition aligns with the expected value.

Understanding the pre-approval process is essential when considering a car title loan, especially in cities like Houston where same-day funding is common for approved applicants. It allows you to shop around and compare offers while knowing your financial limits. Once pre-approved, the lender will facilitate a seamless title transfer, making it a convenient option for those needing quick access to cash.

Benefits of Pre-Approved Car Title Loans for High-Value Vehicles

Pre-approved car title loans for high-value vehicles offer a range of benefits that can make them an attractive financing option for vehicle owners. One significant advantage is the convenience and speed they provide. Unlike traditional loan applications that require extensive documentation and can take days or even weeks to process, pre-approval processes for car title loans are generally faster due to the use of vehicle collateral. This means that if you have a high-value asset like a luxury car, SUV, or classic vehicle, you could potentially secure funding within the same day.

Another key benefit is access to higher loan amounts. Because these loans are secured by your vehicle’s title, lenders can offer more substantial funding compared to unsecured personal loans. Additionally, the pre-approval process involves a quick vehicle inspection to determine its value, which ensures that you receive a loan amount suitable for your high-value asset. This flexibility can be particularly beneficial when unexpected expenses arise or when you need funds to make a significant purchase related to your vehicle.

How to Maximize Your Pre-Approval for Maximum Funds

Drie.

Windo, drajní.

Seki hay n.

Nginx.

Jابه, n.

#Gапير, n drien, o 5.,

|

Car title loan pre-approval is a powerful tool for individuals looking to access substantial funds secured by their high-value vehicles. By understanding the pre-approval process and its benefits, borrowers can make informed decisions and navigate the loan market efficiently. With careful consideration of factors like vehicle condition and repayment terms, pre-approved car title loans offer a convenient and flexible financing option for those in need of quick cash.