In the gig economy, car title loans provide a reliable financial safety net for workers with flexible but unpredictable income streams. Lenders assess eligibility based on proof of income, vehicle ownership, and creditworthiness, offering tailored assistance to gig workers. Preparations include gathering essential documents and understanding repayment terms for a smooth application process.

In the dynamic landscape of the gig economy, financial flexibility is key. For those relying on freelance work, understanding car title loans can open doors to immediate funding. This article equips gig economy workers with essential knowledge about car title loans, demystifying their eligibility criteria and application process. By navigating these tips securely, you can access much-needed capital, empowering your professional journey. Explore the benefits of car title loans tailored for your unique situation in this ever-changing workforce.

- Understanding Car Title Loans in the Gig Economy

- Eligibility Requirements for Gig Workers

- Navigating the Application Process Securely

Understanding Car Title Loans in the Gig Economy

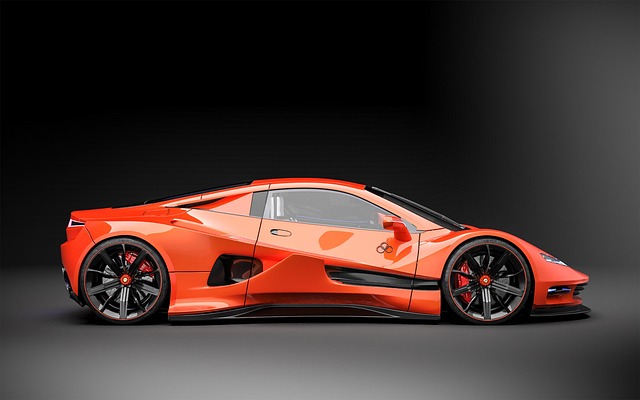

In the fluid landscape of the gig economy, where income can be unpredictable and work hours vary wildly, accessing reliable financial solutions is essential for workers to navigate their daily lives. Car title loans have emerged as an option tailored specifically to meet the needs of this unique workforce. This type of secured loan uses a vehicle’s title as collateral, providing access to funds without the stringent requirements often associated with traditional bank loans. For gig economy workers with limited credit history or poor credit scores, car title loans can offer a much-needed financial safety net.

Given the nature of their work, many gig economy participants struggle to maintain consistent credit due to inconsistent cash flow and lack of formal employment. Bad credit loans like car title loans in Fort Worth can serve as a viable alternative to bank financing, offering flexibility and accessibility for those seeking a quick financial solution. This approach allows workers to maintain control over their vehicles while accessing much-needed capital to cover unexpected expenses or bridge the gap between jobs.

Eligibility Requirements for Gig Workers

In the gig economy, where flexibility meets financial uncertainty, many workers are turning to car title loans as a source of quick funding. However, before applying, it’s crucial to understand the eligibility requirements specific to this unique workforce. Car title loan providers recognize the dynamic nature of gig work and often have more flexible criteria compared to traditional lenders. While each lender may have slightly different standards, there are some common factors that contribute to eligibility.

One key aspect is proof of income. Gig workers must demonstrate a steady stream of revenue from their freelance or contract engagements. This can be achieved through tax returns, financial records, or even online platforms showcasing past projects and earnings. Additionally, lenders usually require a valid government-issued ID, proof of car ownership, and a clear vehicle title to assess the value of the asset as collateral for the loan. Some providers may also conduct a credit check to evaluate the borrower’s financial health, offering financial assistance tailored to gig economy workers’ unique circumstances.

Navigating the Application Process Securely

Navigating the application process for a car title loan as a gig economy worker can seem daunting, but with the right preparation, it can be a smooth and secure journey. Start by gathering all necessary documents, including your driver’s license, vehicle registration, proof of income (such as pay stubs or direct deposit statements), and a list of your existing loans. Understanding the loan requirements is crucial; most lenders will assess your creditworthiness based on your earnings and the value of your vehicle.

Gig economy workers often appreciate the flexibility offered by car title loans, allowing for manageable monthly payments tailored to their income. When applying, ensure that you communicate your preferred repayment method, whether it’s direct deposit or in-person payments. This straightforward approach ensures a transparent process, empowering you to focus on what matters most: continuing your gig work without financial strain.

Applying for a car title loan as a gig economy worker can be a strategic financial decision. By understanding your eligibility, navigating the application process securely, and leveraging this short-term financing option responsibly, you can gain access to funds quickly, providing a safety net during unpredictable work periods in the gig economy. Remember, car title loans are intended for emergency financial needs and should be repaid promptly to avoid potential negative impacts on your future opportunities.